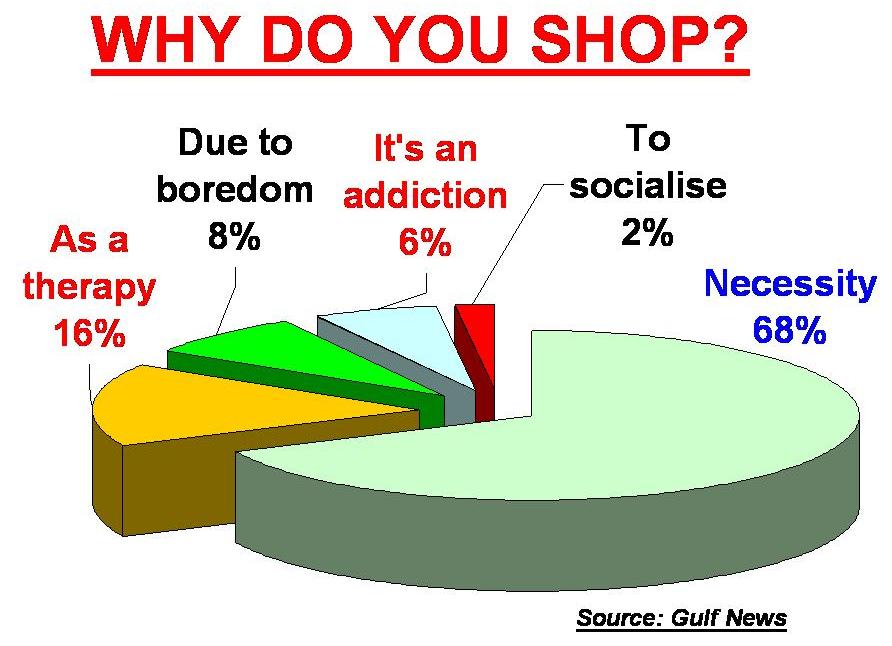

Recent articles in Gulf News and Medical News Today quoting American Journal of Psychiatry indicated that there may be 10 million plus people in US alone, who shop compulsively, placing their work, families and their mental health in jeopardy! And in UAE, going by lower rates for personal loans, frequent launch of attractive credit card promotions (sometimes even by Finance houses), pushing loans to boost bank earnings, and high growth potential for credit cards in the region, we may expect to have our own share of compulsive shoppers soon! In a recent online poll by Gulf News indicated that 16% of respondents do shopping as a therapy – for 6% it’s an addiction, 8% do it to tackle boredom and 2% do it to socialize.

Recent articles in Gulf News and Medical News Today quoting American Journal of Psychiatry indicated that there may be 10 million plus people in US alone, who shop compulsively, placing their work, families and their mental health in jeopardy! And in UAE, going by lower rates for personal loans, frequent launch of attractive credit card promotions (sometimes even by Finance houses), pushing loans to boost bank earnings, and high growth potential for credit cards in the region, we may expect to have our own share of compulsive shoppers soon! In a recent online poll by Gulf News indicated that 16% of respondents do shopping as a therapy – for 6% it’s an addiction, 8% do it to tackle boredom and 2% do it to socialize.

Compulsive Shoppers are those people who "shop till they drop" believing that they will feel better if they do so, and often run their credit cards up to the limit. The behavior may result in interpersonal, occupational, family and financial problems in one's life. In many ways the consequences of this behavior are similar to that of any other addiction.

Looking at the scores of promotions running throughout the year, e.g. DSF, DSS, Ramadan, Eid, Christmas, GITEX, etc. and more, one might tend to think that UAE is indeed promoting more and more shopping! Celebrities coming to

Shopping in UAE often equates psychiatric treatment. It means different things to different residents; e.g. a cure to combat loneliness; a source of evening entertainment; a venue for a family outing; a source of enhancing one’s self-esteem; or sometimes...just to give rein to a compulsive disorder (see pie chart).

How to avoid shopping habit to degrade into a compulsion?

Although the importance of judging one’s own spending couldn’t be better highlighted, I’ve provided some additional links below to tackle the personal / psychiatric aspect of this.

On a socio-economic level, here are a few ideas worth exploring in UAE:

- Ceiling on the number of promotions in a year. For example, 2-3 grand promotions in a year – DSF, DSS and any other one. This will reduce the impulse to “grab the offer” every time.

- Ceiling on the extent of discounts advertised. Many a times we see “Up to 70% discounts” in the malls / outlets, which is rubbish! More realistic discount values will restrain the compulsion need for shopping.

- All Grand Events need not be equated to heavy promotion. Limiting promotional activities within the grand events will reduce the rush for shopping within those few days of shopping.

- Cut down easy loan availability on credit cards. Easy credit on credit cards is one of the worst nuisances existing in the market. Imposing stricter conditions to offer such loans as well as accepting such loans will create a lesser indebted society!

- Establish stricter / heavier collaterals on personal loans. This will limit personal loans to situations when you need them badly – not just to pay your credit card or buy that expensive watch! Hence creating a lesser indebted society again!

- Enforce stricter rules for Credit Card promotions. Restricting launches of rampant promotions will limit newer customers as well as limit spending on existing credit cards, thus affecting binge buying.

- Squeeze cash-flow in the market. Restricted cash flow will retrain spending and hence limit visits to shopping malls.

- Is Compulsive Buying a Real Disorder…?

- Men Suffer From Compulsive Shopping Too

- Shop till you drop 'is a desire gone out of control'

- How to manage compulsive shopping or spending addiction

- Compulsive Shopping and Spending

- Is compulsive shopping eating up your wallet?

- Five ways to stop the urge to shop

- What Is Spending Addiction?

- Shopping and other addictions

- Defining, confronting and helping shopping addiction

- Spending addiction forum

- Addiction and other psychological problems

- Supermarkets: psychiatric treatment in a shopping cart

Technorati :